Commercial Debt Collection and Recovery Attorneys in Florida

My clients are businesses that need an expert for Florida debt collection and recovery and I provide professional, fast, risk-free results. My proprietary system and expertise allow you to recover cash and profitability while freeing time to increase your market share. We’ll professionally represent you to collect receivables from delinquent customers. To date, I’ve recovered over $75M for my commercial clients, with a typical complete fund recovery within 45 days.

Stevens & Ricci and Florida Debt Collection Attorneys Can Help You Collect Past Due Receivables Faster

Whether you are considering using Florida Debt Collection Attorneys or a Florida Collection Agency to assist with collection of your receivables that are past due, we offer some suggested options and guidelines that may help in your efforts. At Stevens & Ricci, we offer both Florida debt collection attorney services and collection agency services. For your convenience, we have affiliate offices in Boca Raton, Clearwater, Coral Springs, Fort Lauderdale, Fort Myers, Fort Walton Beach, Hollywood, Jacksonville, Largo, Miami, Naples, Orlando, Punta Gorda, Sanford, Sarasota, St Petersburg, Tallahassee, Tampa, West Palm Beach, Winter Park, and other cities in Florida. For any are we can send a local private investigator and one of our collectors or legal staff from one of our locations in Florida to identify assets at the debtor’s business location and help you get payments or paid in full quicker. You can find Florida Debt Collection Laws and Limitations here.

Set Your Own Collection Fee

Have a Question?

Ask an Expert!

We would love to hear from you! Please fill out this form and we will get in touch shortly.

Stevens & Ricci Regional Sales Office

2420 Snug Harbor Dr W Palm Beach, FL 33410

(888) 722-1611

Florida Debt Collection Attorneys

If you are not satisfied with the performance of the typical Florida collection agency, consider using the corporate debt recovery services of the Stevens and Ricci firm. When you compare the results of collection attorneys who specialize in commercial debt collection to the efforts of a normal agency, you will be pleasantly surprised at the difference. Instead of having to wait months to see some of your money collected, our vast network of business collection attorneys generally provides results in less than 45 days. Our recovery rate of 72% also outperforms the typical agent’s lower 28% performance. Call our debt collection attorneys in the Fort Lauderdale or Miami, Florida area today for a consultation!

Our West Palm Beach, FL Collection Attorneys Provide Superior Results

When you consider the number of critical opportunities sometimes missed by a regular collection agency, it is not surprising our organization provides outstanding debt recovery results. Many collection agents simply make phone calls and give up quickly when there is no response. Compare that to the network of collection experts that we have at our disposal. We may start with a phone call, but we never stop there. If your debtor chooses to avoid our calls, our collection lawyers contact the private investigators that are part of the collection network to track down the debtor wherever they might be. Once they are found, the collection attorney steps back in to present the available options for repayment to the debtor.

It doesn’t matter where your headquarters are located, there is a Stevens and Ricci commercial debt recovery staffed team waiting to help you with your collection problems. In addition to saving time and money, we bring countless other advantages to your corner. Instead of giving up and moving on when your debtor hires their own legal counsel, our attorneys take advantage of this opportunity to advance the payment negotiation process. Because our network of business collection attorneys have privileges with the court that a collection agency does not have, we can petition the court and force the debtor to appear to disclose company financials and their complete financial portfolio. It will put an end to the payment excuses once and for all. Continue reading to discover additional ways that we can help you with Orlando, Florida business with commercial debt collection.

CAUTION

CAUTION

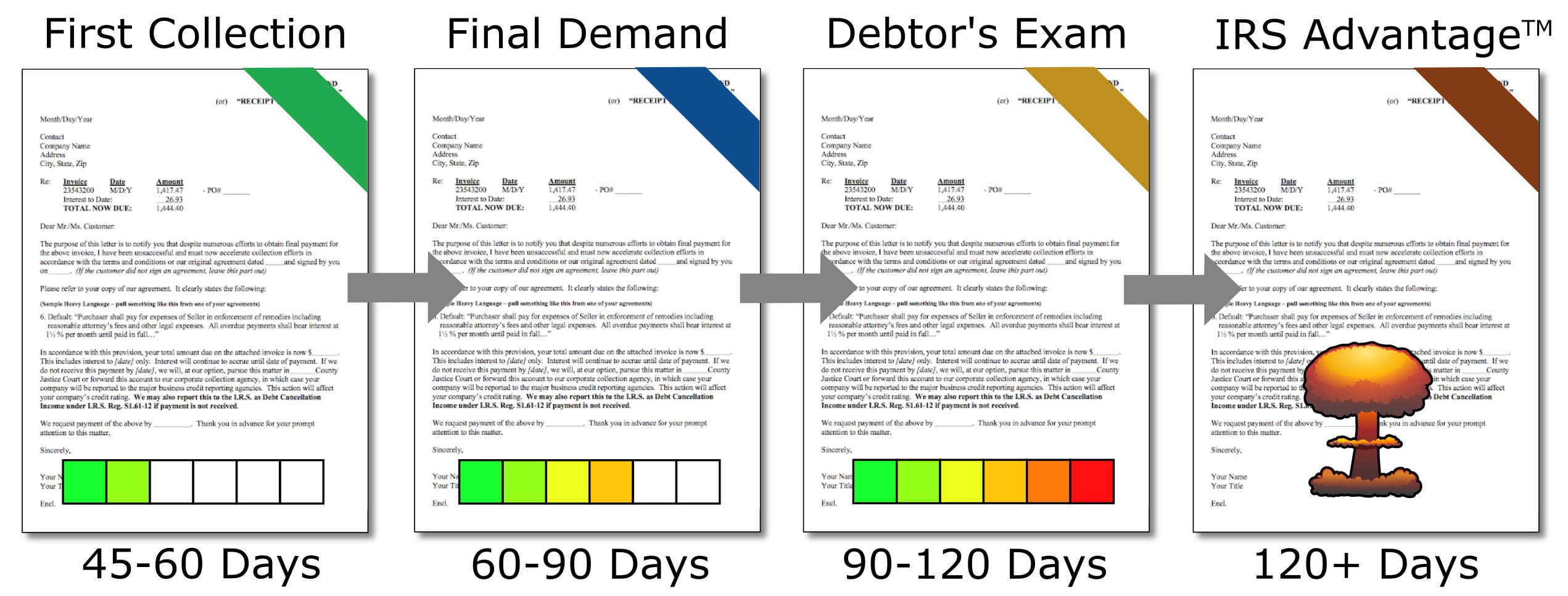

Most businesses wait twice as long as they should before turning accounts over for collection. Don’t make this costly mistake! For every 30 days, the chances of collecting drop another 12%. If you’re not ready to commit to a collection agency or attorney, I’d like to suggest a couple of NO COST options as a smart “next step”:1. Send a strong Final Demand Letter from your company. We offer a sample Final Demand Letter template for you to download.2. Have us send a Legal Demand Letter to your past-due customer giving them 10 days to pay or face an aggressive legal collection process.Contact us if you have questions about a specific slow pay or no pay receivable.

The Stevens & Ricci Difference

The Florida Lawyers for Business Debt Recovery in our network will provide numerous additional advantages to your business debt recovery needs. In addition to outperforming the collection agency in virtually every case, they also have knowledge and authority that is not available to those outside the legal arena. Collection attorneys can file motions with the court to force debtors and their agents to appear and disclose sensitive financial information. When a debtor obtains legal representation, most collection agencies will immediately give up. Our commercial debt collection attorneys welcome this development. We will seek out their counsel to start negotiations that are more advanced. The following sections provide even more strategies that a normal collection company would never consider trying.

Principal Identification

The theories of liability and alter egos can be successfully used by debt collection attorneys to collect debts from the owner of the business. Much of the corporate debt that goes into collection is fraudulent. Sometimes, a dishonest person will run up debt in the corporate name, and then close or sell the office without filing bankruptcy. By hiding behind the corporate veil, the debtor has put the creditor in a poor bargaining position because there is no personal guarantor, only a failed corporation. The theory of liability will often allow the debt collection attorney to pursue the principals. The alter-ego theory can also be used to collect debts in these situations. When a business owner uses non-corporate funds to pay for business expenses, the attorney can argue that the business owner personally owes the debt because the corporation was illegal.

Consent Judgments

When a debtor cannot pay in full, they will often agree to a short-term payment plan. The debt collection attorney may be able to strengthen this agreement by creating a consent judgment. If the debtor can be persuaded to sign it, the creditor will be able to obtain an immediate judgment if even one payment is missed. This process allows the debtor’s bank account to be seized without the need to spend additional time or money in the courtroom. In most cases, we already know the banking information from previous documents and can immediately seize the funds to pay the debt. A consent judgment dramatically increases the chances of payment for our Miami and Florida clients and puts them in a better position than most secured creditors.

Business Sales – Advantages of using Florida Lawyers for Business Debt Recovery

In the event of a full liquidation, most collection agencies would be at a loss. The same would hold true for a bankruptcy, acquisition, or merger. A commercial debt collection lawyer can often obtain the buy/sell agreement from the owners or their agents. Many of these documents provide set-aside provisions or reserve allowances for paying secured creditors with open balances.

Case Studies