Business To Business (B2B) Debt Collection

“Profit is an opinion. Cash is a fact.” This expression is common among business to business debt collection professionals. What does it mean? Simply put, your business provides a valuable product or service in your marketplace. Selling that product or service should yield a profit. But until you see the cash, “profit” is only a theory. The sobering fact is that collecting a receivable from a delinquent customer is a headache that robs you of time. Stevens & Ricci Inc. provides B2B Debt Collection on contingency and a top-level service to collect your outstanding B2B debts.

The Stevens & Ricci Advantage

You are not a banker or a small business lender. You’re not in business to carry your customers’ debts, yet every day you don’t collect on deliquent accounts you are in all praticality, lending.. Every day that passes you become less likely to collect on deliquent accounts. Let us help you convert your past due receivables into cold, hard cash

Attorney Leverage

We work with our carefully selected, specialized attorneys in your debtors jurisdiction nationwideWe carefully select one of our partner attorneys in your debtors jurisdiction for each of our individual client cases. We select those who specialize in debt collection cases with a track record of success.

Professional

Our B2B collection efforts are professionally aggressive, effective and affordableOur skilled professionals are courteous and effective, resulting in a successful collection that both collects on the debt without damaging the relationship between the debtor and our clients.

Collection Expertise

We have been collecting on B2B debts since 1997 To date and have recovered over $75 millionWith over 23 years of hands-on experience in business to business collections, we help our clients navigate the challenging landscape of collections and help them begin collecting on debts right away.

Your Cost

We work on a contingency basis which means our fee only applies to money successfully collectedWe collect on a contingent basis as per our fee schedule. Court costs up front (quoted case by case per state) plus a contingent rate fee of 35%. Our fee only applies to money successfully collected.

Testimonials

“Dollars recovered is in excess of 80%”. Although we pride ourselves on our internal collection abilities, we have found it very helpful to utilize the services of a third party business to business recovery firm to assist in the collection of our accounts receivable.

We have been working exclusively with Stevens & Ricci since 2001 because of their expertise in quickly and professionally recovering our accounts. We have found that their staff is adept at dealing with any type of business or legal issue that might arise in the recovery of our accounts and should an account have to be litigated, the process is seamless. Most importantly, Stevens & Ricci’s collection rate of dollars placed versus dollars recovered is in excess of 80%. This bottom line pleases both our Board of Directors and shareholders.

More ‘bang for the buck’, At first I was skeptical of Stevens & Ricci’s conversion from collection agency to attorney group and brokerage. We have been a client for over three years and I’ve always said “If it’s not broke don’t fix it.” We placed a large customer recently which was assigned to a Stevens & Ricci attorney. The account was resolved because in today’s debtor savvy culture, a seasoned collection attorney will command and get a higher level of respect and attention than an agency collector. Further, the attorney is in a better position to overcome objections from the debtor which can delay or prevent collecting. The cost is the same but more dollars are recovered. We’re getting more “bang for the buck” with Stevens & Ricci.

“I truly am impressed”. I am so impressed with your company, I just wanted to send you a note to thank you for all of your continued help.

I have been in Accounts Receivable for over 5 years and have been dealing with many different business collection agency’s in various states and never had any luck with any of them. They seem to promise you everything just to get the account.

I have never dealt with a more professional, effective, and efficient company such as yours. You are there to answer any questions, no matter how big or small. I also appreciate the reports you send updating my account on a regular basis. I truly am impressed how quickly you got our money back from several clients that would not return my calls, etc. I told my superiors I will never deal with any other agency and have recommended many of my clients to you and will continue to do so. I truly appreciate everything.

Business to Business Collections With Stevens & Ricci Inc.

Stevens & Ricci Inc. provides B2B Debt Collection services on a contingency and a top-level service to collect your outstanding B2B debts. When it comes to b2b debt recovery time is not on your site. Timing is the most important thing that matters when your business has outstanding account receivables. If you want to cut your losses and collect your debt, you need to be among the first ones to get there.

It would be an understatement to say that many debtors do not take collection agents seriously. In such cases, your only option is to file a lawsuit by hiring the services of a litigation attorney. However, this takes a lot of time and money. We have combined legal and collection services in a single function that works in a synergistic manner to help prevent any lost opportunities.

What sets us apart from other debt collection services is that we always focus on preserving the relationship between the debtor and our clients. We understand that every business faces some problems and outstanding account receivables should not result in damaging the relationship. Our team of trained professionals is highly skilled in negotiating debt collection that not only helps in collecting the outstanding debt but also preserves the relationship.

Our professionals are always courteous and the threat of continuous collection effort in the future, followed by litigation (if needed), results in successful collection of the outstanding debt without harming the relationship. In fact, our way of working has the ability to turn potential losses into big future profits.

As far as the services provided by Stevens & Ricci, we offer business debt collections for wholesalers, manufacturers, service companies, and various other types of commercial accounts.

Reasons Why You Should Work With Us

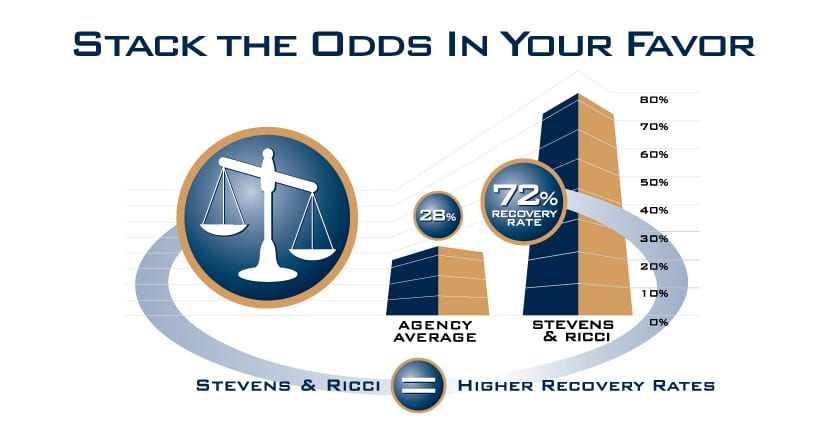

We work on a contingent basis which means that we are not going to take any fees unless we are successful in collecting all or some of your debt. (See our fee schedule) In addition, we combine collection services with attorneys which means there is a 58% increase in the collection rate. Stevens & Ricci Inc. is a national collection firm that serves the entire country (USA) and International clients.

Technology and laws have evolved a lot over the past few decades and the debtors today have access to a lot of information and are much savvier. Access to information and enactment of various laws has made it tough for creditors to collect their debts in all the industries. Therefore, it is time that creditors also change their ways and adopt a more aggressive and sophisticated way to collect their debts.

It is true that you can always file a lawsuit to collect your outstanding debts but lawsuits typically require upfront costs. Further, filing a lawsuit extends the time that is needed to collect the debt, there are fees involved, and there is always the chance of debtor filing own lawsuit.

This is the reason that we strive to act as mediators to resolve any kind of dispute. It has been our experience that early intervention by an attorney helps in preventing escalation of matters to lawsuits.

This does not mean that we shy away from filing lawsuits to get back the money. If there is no other way left to collect the debt, we do begin the legal proceedings for collecting the debt.