Company Credit Check

Every time you take on a new customer, you take on additional risks. Will they pay on time? How late will they be? And, don’t worry, if you don’t have a credit policy, your customers will create it. It just won’t be to your advantage.

Consider that of the $2.5 trillion in account receivable debt in the US, 17% is delinquent. Bad debts continue to skyrocket, as businesses file for bankruptcy or fail entirely.

If you’re not able to identify red flags before taking on a new client, your profits are at risk. Thankfully, there’s a solution. Conducting a company pre-screen credit check can highlight risks that would otherwise be missed, helping you make informed decisions about new clients and protect your financial stability.

Interested in learning more about how a business credit check can help or how we conduct checks and deliver critical information? Download the Free Guidebook today to get started.

The Importance of Prescreening

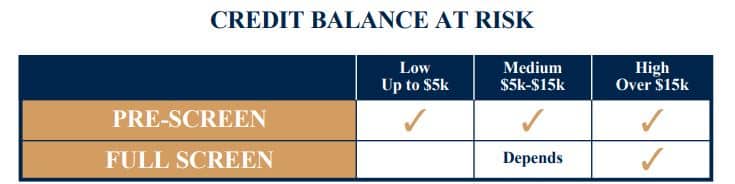

All accounts, no matter their size, should be prescreened using an online state corporation report for analysis, how they answer their phone, and online indicators that speak to business stability and success, like customer reviews, a modern website, and a social media presence.

It’s also worth checking sites like Glassdoor to glean employee comments and sentiments about morale and company culture. These checks usually take only a few minutes and don’t require a lot of money, but they can yield critical insights to inform your decision-making process.

Unsure how to conduct a company credit check? We can help. Download the Free Guidebook to learn more.

Full Screening for Certain Accounts

While all new accounts should be prescreened, it’s important to dig deeper when it comes to mid and high-value accounts. Checking business credit for these potential clients is essential because they have the potential to make a huge impact on your financial stability.

What’s included in this type of company credit check, though? It should be an in-depth process and it will take a considerable amount of time and money, but you should pull their full credit report (with trade line experiences), conduct a financial statement analysis, their credit score, search for mechanics liens, bonding, and verify UCC1 security interest filing.

Concerned that you lack the time or expertise to conduct a full company credit check on this scale? We can help. Download the Free Guidebook for complete information.

How to Check Business Credit Step by Step

Checking business credit can seem like a daunting prospect, but it can be quite simple with the right steps.

Step 1: Search Corporate Records Online

Visit http://www.blackbookonline.info/USA-Corporations.aspx

From this page, you can easily find the state where your potential client is located. Click through and you’ll find entries that allow you to check business credit for any corporation or LLC within that state. As you conduct your company credit check, verify the following:

- Verify their time in business.

- Check their corporate status.

- Check the name of the registered agent.

- Verify the state of incorporation.

- If the client is an LLC dig deeper into the structure.

- Verify the officers and principals and their backgrounds.

- Is there a DBA? If so, what business is behind it?

- Verify the business address and check it against the one on the sales order/credit application.

Step 2: Make the Call

If you’re dealing with a potentially risky client, place a phone call to their offices. If the phone is not answered by a live person who provides the name of the business, it should be considered a yellow or red flag, unless you’re presented with an automated business directory. A business-branded voicemail box could be a yellow or green flag. Anything else is a red flag.

Step 3: Check the Age of the Web Domain

Use https://websiteseochecker.com/domain-age-checker/ to verify both the age and the domain authority of the potential client’s website. Young and/or low-authority sites can mean greater risk.

Conducting a company credit check before bringing a new client aboard is essential. Newer, smaller businesses often represent significant financial risk, and you must mitigate them. However, conducting in-depth business credit checks and assessments can be time-consuming and costly. If you’re concerned that you’re unable to do your due diligence here for each and every new client, we can help. Download the Guidebook today for more information or to schedule your consultation.