Debtors Exam Letter

Debtors Exam Letter

When you reach the point where you feel a judgment is uncollectible, there is one last strategy you can try. Use the Debtor’s Exam Order as a pressure point, explaining what they will have to go through and how an arrest warrant could result.

Collecting Your Judgment

When you reach the point where you feel a judgment is uncollectible, there is one last strategy that you can try. Contact your Small Claims Court (or the court you obtained your judgment in) and obtain the appropriate forms and information to serve your debtor with a Debtors Exam Order (or what it’s referred to in your particular state). The enclosed pages include sample lists for both corporate and individual debtors which spell out in great detail each and every asset that your debtor must reveal and document to the court under oath at this Exam.

Further, you should mention if they don’t show up for the Exam, a warrant will be issued for their arrest similar to an outstanding traffic violation. This can cause them to be taken off to jail the next time they’re pulled over for a traffic violation.

Methods of Use

This technique can be done either verbally or using the letter and attached list of required items – or both. There is a separate collection letter and attached list of assets for corporate and individual debtors. Make sure to use the appropriate set. You will find the most impact is achieved when you speak to the debtor over the phone first, then follow-up with a fax or email You’ll be surprised how many Judgment Debtors will decide to settle up.

Your Final Effort to Collect a Sum the Court Has Awarded You

You’ve sued your debtor, and the court has decided in your favor. But, disappointingly, that hasn’t made it any easier to collect the sum that’s owing. You’ve tried everything, to no avail. What should you do? Is there anything you can do? Or, should you simply give up, write it off, and tell yourself that you did the best you could.

There is indeed something you can do — and it can be remarkably effective: Serve your debtor with a Debtors Exam Order requiring them to appear before the court and present documentation for every asset they or their business owns. There are a few different ways to use this strategy, but they all involve the threat of placing your debtor in the unenviable position of having to reveal all their assets of every type, under oath, and submit to an examination of those assets by the court. This is not a comforting thought to your debtor.

Using Your County Sheriff To Encourage Payment From Your Judgment Debtor

Most judgments go uncollected after being awarded by the court. You’ve tried garnishing banks, assets and wages to no avail. What else can you do?

THE DEBTOR’S EXAM ORDER

Is there a business or individual that embraces the idea of appearing in court to reveal their company or personal assets in the greatest detail? Probably not, and your debtor won’t either. But what’s really amazing is that getting your county sheriff to help you recover the debt is as easy as follows:

1 – Inform your judgment debtor that if they don’t pay, you will have them served with a Debtor’s Exam Order to appear in court to show copies and statements of all property, stocks, bonds, notes, bank accounts, real estate, IRAs, pensions, financial statements, tax returns, insurance policies, and vehicle titles.

2 – Mail or fax either the corporate or individual collection letter along with the asset detail list.

3 – Follow-up with a phone call.

Key Components of the Debtors Exam Letter

Your Debtors Exam Letter is a Final Payment Letter that you send your debtor before filing a request for the court to examine that debtor’s corporate or individual assets. It’s a warning, as well as a final opportunity for the debtor to pay the monies due. This no-nonsense letter doesn’t mince words. It lays out the harsh realities your debtor can expect to face if the monies ordered by the court are not paid by a certain, specific date. And it does this in excruciating detail. The key components of this letter are listed below:

- A detailed summary of the total amount due, with interest

- A statement that you intend to turn the matter over to the court for enforcement

- Verbiage informing the debtor that they will receive a subpoena to appear in court

- A list of the financial assets they’ll be required to document when they appear

- The date by which full payment must be received to avoid this Debtors Exam

- A separate attachment listing all the documentation that the debtor will be required to produce under the subpoena

Create Your Debtors Exam Letter with Our Free Final Payment Letter Download

Our comprehensive tutorial provides everything you need to use this powerful strategy to influence your debtor to pay up in order to avoid the highly unpleasant alternative. The following items are included in this guide:

- Instructions, explanations, and strategies for using the Debtors Exam Letter effectively

- Corporate Debtors Exam Collection Letter & Document List

- Individual Debtors Exam Collection Letter & Document List

- Our highly effective Collection Letter Template, plus attachments, in MS Word.

Download this letter today if you need help collecting the monies awarded you by the court*.

Send ‘em’ to jail!

Don’t forget to mention if they fail to appear for the Exam Order, there can be a warrant issued for their arrest. After the warrant is issued, should they be pulled over for a routine traffic violation, they will not pass go, not collect $200, and go straight to jail.

Once your debtor realizes that the courts will be examining their most confidential business or personal assets, you will be surprised how quickly a check can arrive in the mail.

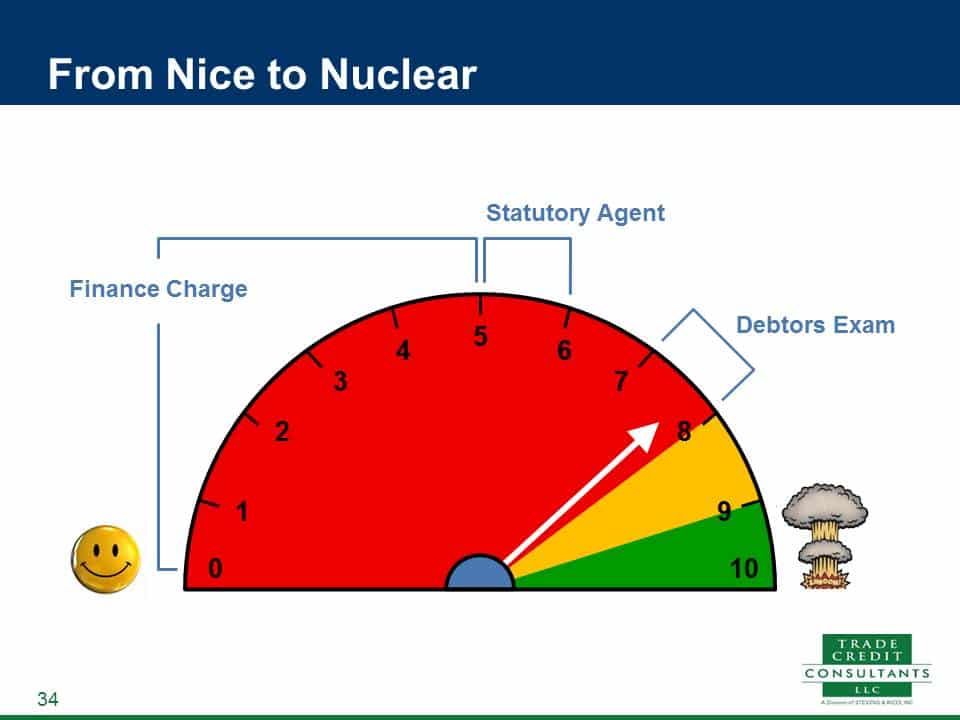

It is important to remember that this is an aggressive approach to collections and should be reserved for only the most stubborn refusals to pay- an effective collection tool to be utilized with discretion and care.

*NOTE: Many creditors have successfully used this tactic on a pre-small claims court basis to avoid having to file the case in the first place. The pressure points are the same and you would have to decide based on the dollar size of your claim. For example, you might employ this technique prior to filing your claim legally, then if it doesn’t work you file the case, obtain judgment if debtor defaults on payment, and proceed to garnish their bank account if you have that information.

Don’t Overlook Our Other Four Valuable Collection Letter Tutorials

All five of our Collection Letter Guides are designed to help you use highly effective commercial debt collection strategies to collect the money that’s due you — and all five are free. So, why not take a moment to browse our selection, so you’ll know exactly where to go the next time you need a strategy for a tough collection issue. You might even bookmark the page to locate it more easily later. Every one of our guides includes an effective Collection Letter Template to make it easier to create your letter.

At Stevens & Ricci, our goal is to simplify collections for your business by helping you Collect Money Sooner, at Lower Cost, and Without Losing Valued Customers.