Collection Negotiation Techniques

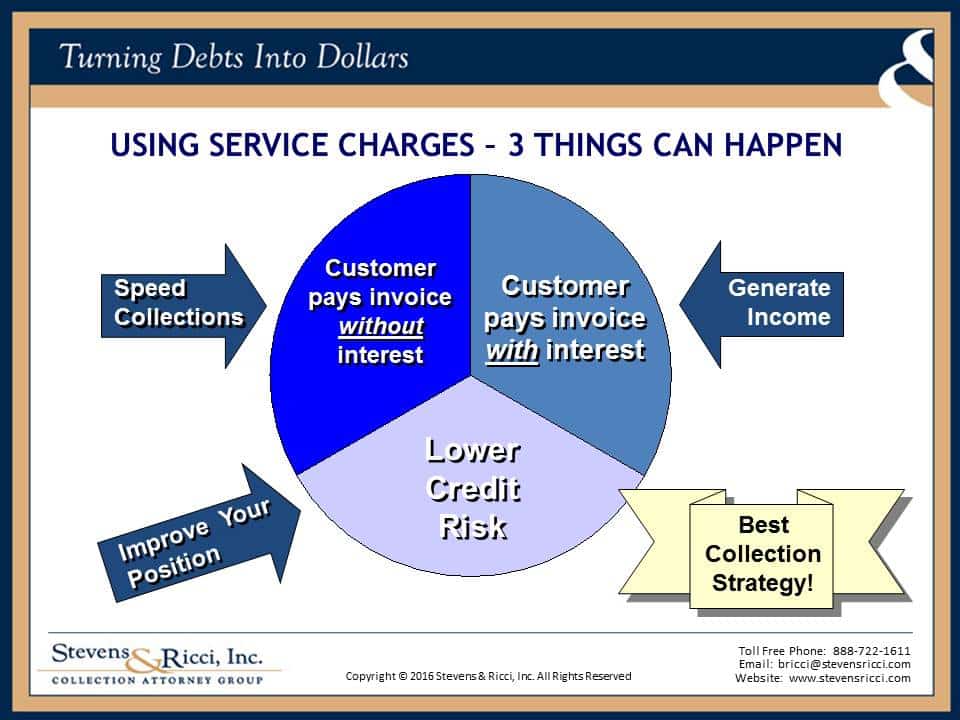

Dealing with slow to pay and non-paying customers? There’s a secret that allows you to increase collections by 66% or more. Charging interest is one of the smartest strategies and can both increase the cash flow through your business and decrease the time it takes your customers to pay their debt.

Take an Example from Banks and Other Lenders

Not sold on the idea of charging interest on accounts receivable? Think about this – why are banks and other lenders always among the first entities to be paid by their commercial customers? It’s simple – finance companies enjoy top priorities because not doing so comes with steep penalties, including additional interest and fees that increase the costs of doing business.

So, why aren’t your customers paying you? Simply put, you are not a priority because there are few consequences if they don’t pursue settlement of a debt. In fact, some may even be practicing what’s called trade creditor financing, where they use their debt to you as a line of credit.

It’s time to stop lending and find a way to turn those trends toward your organization’s best interests. Download the Free Guidebook and White Paper to learn more about how finance charges can resolve debts, decrease the time for customers to pay, encourage them to pay in full, or even add additional revenue to your organization.

Turn Your Company’s Finance Charge into a Strategic Leveraging Tool

Without an incentive to pay past-due invoices, your customers will drag their feet. It’s in their best interests to pay as slowly as possible, because this allows them access to additional funding, at your expense.

However, by adding interest charges to past-due invoices, you automatically increase the urgency of repayment and bump your company up in the queue for the next available accounts payable dollar. It’s a proven technique to increase the speed of settlement on a debt.

Aren’t you ready to leverage interest charges and change the slow-to-pay paradigm? Download the Free Guidebook and White Paper today for more information.

Use Finance Charges to Improve Your Position

How often do your customers ask for extended terms? Worse, how often do they simply extend those terms on their own? In these situations, you can use finance charges to improve your position concerning the credit default risks posed by the customer.

The goal remains the same – increase the chances that the customer will pay quickly and in full. However, that doesn’t mean that you cannot grant a request for extended terms. Determine what your position is and then make the ask. If the debtor declines, there’s a deeper cause and they likely cannot meet their financial obligation in the first place. So, how do you position yourself to benefit in these situations?

- Signed credit agreements

- Written acknowledgment of the debt

- Promissory notes

- Personal guarantors

- Blanket security agreement

- Purchase money security agreement (PMSA)

Ready to learn more about using finance charges to improve your position? Download the Free Guidebook and White Paper today.

Generating Revenue with Finance Charges

As you offer interest charges in exchange for extended terms and other benefits, you’ll find that they do one thing amazingly well: generate significant interest revenues for your business. And while you’ll only collect interest from a very small segment of your customer base, those revenues can cover or even exceed the carrying cost of your entire A/R portfolio.

After all, you’ll be charging 1.5% per month (18% per annum) and your actual cost of funds is much lower. It’s possible that with the right strategy, you could add $100,000 or more in cash flow to your organization through finance charges alone.

With finance charges, you can:

- Recapture costs incurred when a customer is slow to pay.

- Boost cash flow within your business as you resolve debts.

- Encourage customers to pay on time and in full.

Download the Free Guidebook and White Paper today for more information about using finance charges to generate revenue and how we can help.

How to Start

Selling interest is nothing more than a unique collection technique. It can also be a source of revenue for your organization, and it can train your customers to pay sooner and in full. Use discretion about which customers to avoid damaging delicate relationships with key customers or instances where late payment is due to a legitimate error or oversight.