Collection Letters

The Best Debt Collection Letter Guides and Templates for your Business

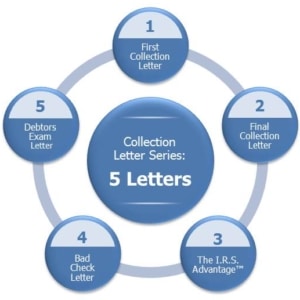

Below are the Five (5) best collection letter samples available. Developed by industry leader Ben Ricci, the following five collection letter samples have proven to boost collection rates by up to 40%.

Unlike most debt collection letter templates, these come with complete how-to-guides to ensure they are used correctly in order to achieve optimal results.

Download Collection Letter Samples

First Collection Letter

First Collection Letter

The purpose of a collection letter is to get your debtor’s attention, but that almost never happens on the first try… Until now. The first collection letter sample maximizes the results of a first follow-up by actually getting the attention of your debtor at an early stage.

This unique (and shockingly simple) formula increases early collection rates, thereby cutting the amount of time you usually spend chasing down delinquent debtors. Download Now Early Collection Letter

Final Demand Letter

Letting your debtor get away without paying is unfair. Taking your debtor to court is time-consuming and expensive. When it comes to stubborn debtors, those used to be your only two options. This time-tested sample demand letter for payment legal sample is option number three. It’s so powerful that it has resulted in payment in as many as one-third of all cases without going to court. A good final demand letter needs more than just the right words—it needs to be sent at the right time and to the right person. This guide reveals how to effectively check all those boxes. Download Now Final Demand Letter

Debtors Exam Letter

When you reach the point where you feel a judgment is noncollectable, there is one last strategy you can try. Before throwing in the towel or paying someone to collect payment for your company’s past-due accounts, try this method as a final attempt. This sample collection letter will hit a pressure point that your debtor won’t expect and, therefore, won’t ignore. If your debtor had the option to either pay you or reveal all of his or her assets in court, which option do you think he would pick? This letter creates that situation for your debtor, forcing him to finally pay their debt. Download Now the Before Action Collection Letter Sample

IRS Advantage™ Letter

You can legally get the IRS to help you combat delinquencies, and this guide reveals how. This most aggressive collection letter sample has helped countless businesses drastically reduce third-party expenses and collect their most delinquent receivables faster than ever before. This approach can increase your in-house 90-day account collections by 50% or more, and this letter has proven to get even the most delinquent debtors to finally pay their debt. You can’t beat having the IRS on your side in a collection matter. Cut through the lies and get customers to finally pay their debt. Download Now This Aggressive Collection Letter

Bad Check Letter

Even though receiving a bad check is less common for some businesses, it’s crucial for every type of business to know how to deal with it before it occurs. Collecting late payments is enough of a headache, and, if you aren’t prepared for a bad check situation, that headache will only get worse.

This free bad check letter sample makes it significantly easier (and quicker) to collect payment from a debtor who gives you a bad check. Nearly 90% of bad checks are drawn on accounts less than one-year-old. Download Now Bad Check Collection Letter

Video Tutorial On How To Use The Collection Letters

You’re credit and collection department is only as strong as your weakest link. Even a SMALL improvement in any of your letters will make a huge impact because of the multiplier effect. You’re sending the same letters out hundreds or thousands of times each and every year. So use our collection letter templates to start collecting more money, sooner, at less cost, and without losing valued customers.

Most businesses only need three to five demand letters for payment. A good letter can not only result in payment but also when followed up with a phone call will increase collections and in less overall time spent. You can download these five collection letter samples to make sure you are using the most effective letters for your business. Save time by getting to the bottom line faster. This allows more time to spend on other activities to prevent more delinquencies.

Most businesses only need three to five demand letters for payment. A good letter can not only result in payment but also when followed up with a phone call will increase collections and in less overall time spent. You can download these five collection letter samples to make sure you are using the most effective letters for your business. Save time by getting to the bottom line faster. This allows more time to spend on other activities to prevent more delinquencies.

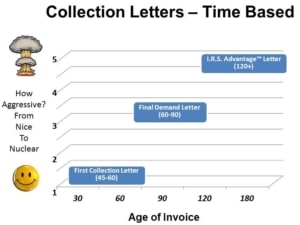

These first three sample demand letters are time-based in that they are used at set time ranges from invoice date. The first collection letter is actually more of a customer service letter because it doesn’t even ask for a payment, rather the reason for non-payment. The final demand letter is probably the most important and frequently used commercial letter when you hit the sixty to ninety-day invoice date range. The IRS letter is outside the box. It’s a last resort and this helps avoid agency and or collection attorney expenses.

These first three sample demand letters are time-based in that they are used at set time ranges from invoice date. The first collection letter is actually more of a customer service letter because it doesn’t even ask for a payment, rather the reason for non-payment. The final demand letter is probably the most important and frequently used commercial letter when you hit the sixty to ninety-day invoice date range. The IRS letter is outside the box. It’s a last resort and this helps avoid agency and or collection attorney expenses.

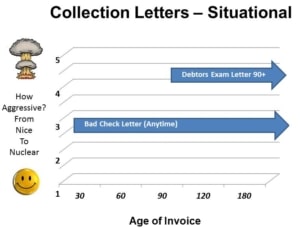

These two debt collection letter templates are situational as opposed to time-based in that they are special situations that don’t occur on a regular basis. The Bad Check Letter is good to have on hand just in case. For commercial creditors, bad checks are rare. But they do happen and you want to be ready for it if and when it does. The Debtors Exam letter is good for both collecting a small claims court judgment and better yet avoiding small claims court with this threat that includes an arrest warrant against your debtor if they fail to appear.

These two debt collection letter templates are situational as opposed to time-based in that they are special situations that don’t occur on a regular basis. The Bad Check Letter is good to have on hand just in case. For commercial creditors, bad checks are rare. But they do happen and you want to be ready for it if and when it does. The Debtors Exam letter is good for both collecting a small claims court judgment and better yet avoiding small claims court with this threat that includes an arrest warrant against your debtor if they fail to appear.

If sales is the engine, credit is the oil. Your profits depend on it. Another way to put this is: Sales drives revenue, but credit ensures profits. We would like to show you how to: Collect more money, sooner, at less cost, and without losing valued customers. Thanks for watching. And best of luck turning Debts into Dollars.

Collection Letter Sample Details

First Collection Letter

Stevens & Ricci has developed this First Collection Letter template to maximize your first follow-up success rate. Using a unique format based on debtor psychology, this letter has been tested in a true commercial collection environment for several years.

As a general rule, in early collections, a phone call is ten times more effective than a written letter. This is mainly because at this state a two-way dialogue is far more effective than one-way communication.

But like many rules in collections, there are exceptions. You might need to send a first collection letter vs. calling for smaller balances accounts because letters can be automated whereas phone calls are manual and more time-consuming…

Final Demand Letter

Phone calls are better in the early stages of collection, but in the later stages, the written word in the legal context is far more powerful than speech. Here’s how to build a custom five-part template letter for your business.

Use a Final Demand Letter for payment before taking your debtor to court. When all other collection attempts fail, you have a choice: either let the matter (and your money) go, or take it to court. A written Final Demand Letter is recommended by most courts, and required by a few, to file suit.

Keep in mind, though, that you don’t want to go to court; you want to collect the monies owed. This sample Demand Letter sells the need to pay while fulfilling the legal requirements…

IRS Advantage Letter

This IRS Advantage Letter is a breakthrough in accounts receivable. This is the most powerful collection letter template and can help you collect your most delinquent accounts using the fear of the IRS. Perfectly legal, and used by lawyers and CPAs to collect their own receivables, this technique incorporates both accounting principles and debtor psychology.

- Drastically reduce third-party expenses and collect your most delinquent receivables faster than ever before

- Legally use the IRS to get the debtor’s attention and make them fear the ramifications of non-payment

- Cut through the lies and get even your most stubborn customers to finally pay their debt

- By far the best and most successful of collection letters…

Bad Check Letter

Bad checks are less of a problem when your customer base is mostly commercial rather than consumer based; but the potential is always there and you should be prepared to deal with bad checks when and if you receive them.

Nearly 90% of bad checks are drawn on accounts less than one-year-old. Be suspicious of checks that have a number less than 125 or no number printed on it at all. Check the date and don’t deposit a check that is postdated – it may be defensible under Bad Check Statutes.

Never ask for a post-dated check in response to a customer who “won’t have the check for two weeks.” In many states, the criminal provisions regarding bad checks do not apply to post-dated checks…

Debtors Exam Letter

When you reach the point where you feel a judgment is uncollectible, there is one last strategy you can try. Use the Debtor’s Exam Order as a pressure point, explaining what they will have to go through and how an arrest warrant could result.

When you reach the point where you feel a judgment is uncollectible, there is one last strategy you can try. Use the Debtor’s Exam Order as a pressure point, explaining what they will have to go through and how an arrest warrant could result.

- Inform your judgment debtor that if they don’t pay, you will have them served with a Debtor’s Exam Order to appear in court to show copies and statements of all property, stocks, bonds, notes, bank accounts, real estate, IRAs, pensions, financial statements, tax returns, insurance, policies, and vehicle titles.

- Mail or fax either the corporate or individual collection letter along with the asset detail list.

- Follow-up with a phone call…

Collection Letter Audio Tips

Below is an audio overview by Ben Ricci giving general tips on the above Collection Letter Samples

Transcript

The first Collection Letter

Taking a look here at the first collection letter sample. The first collection letter is really a customer service function. In the early stages of collections, it’s really more customer service than it is in the latter stages. If you are going to use a first collection letter, and not everybody does, there were times where I never used a first collection letter, I always made a phone call for the first contact. Now, there are some exceptions of course if you’ve got high volume or staffing issues. But if you’re going to use a first collection letter I have found this format and the sample that’s provided in the workbook as well as on the program disk as a Word file to be very effective.

This first collection letter template is very effective. Ten times more effective than the average dunning letter. This here is a two-way dialog as opposed to one-way communication. And what it should or should not do is laid out for you, but basically, it’s just a light fluffy letter, it’s nothing really heavy or accusatory or anything like that. It simply asks for a reason for nonpayment in a very professional and friendly manner. I used to get a lot of these back with the appropriate checkbox at the bottom and it identifies exactly what the problem is and allows you to focus on resolving the solution. And I feel if you’re going to use the first collection letter you ought to at least try this one and possibly modify it to fit your needs.

The Final Demand Letter

Now, moving on to this sample demand letter for payment. This is after you’ve made a few calls, had a few stalls, and it’s time to get serious. It’s kind of drawing a line in the sand and you’re setting this up for advance collections. Now, a final demand letter is really much more effective in writing in terms of calling somebody and verbalizing a final demand. You’re better off putting this in writing because, at this stage of the game, the written word is much more powerful than speech. Now, this collection letter that’s provided here as a sample I have developed and used over years and years and years and I feel it’s about effective as any. So feel free to adopt the language over here to your own letter from this one or just copy and use it as is and modify it.

It’s an excellent letter. It solves the need to pay and it also fulfills pre-suit legal requirements which are required in most small claims courts and justice courts. It has all the necessary elements: the firm opening, the heavy language which you pull from your own documents whether it be a contract or a work order. It’s got a good strong payment demand and has a consequence and a close. And it also leaves them an out. If you look at the last paragraph where you’re telling them all these nasty things you’re going to do to them if they don’t pay but then it gives them a chance to avoid these nasty things like, “We’re not going to report you to the major credit bureaus and affect your business credit rating if you pay this bill.” and things of that nature. And it’s a very well rounded and effective letter.

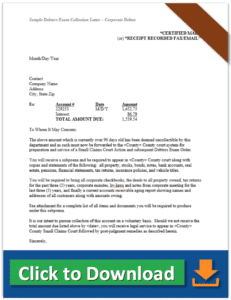

Up at the top in the right-hand corner, I want to point out this receipt recorded fax element. If you send this certified mail it’s more expensive and time-consuming and it’s administratively just more work and money. But if you send this via your fax machine and then you go ahead and print the confirmation that the actual letter went, and staple it to the letter, that is equally as provable in court if you need to prove that they received the final demand letter. And so I always had preferred 99 out of 100 times I would send it receipt recorded fax as opposed to putting certified mail in the upper right-hand corner.

Bad Check Letter

Now, moving on to the bad check letter. Not everybody is affected by bad checks. I would get maybe two or three a year as a credit manager for a commercial business. It’s good to have a bad check letter on hand just in case it does happen. Naturally, the first thing you’re going to do is you’re going to call your customer and you’re going to ask if there was a problem with the deposit. A lot of times they’ll tell you, “Well, you know, we didn’t make a deposit on time and just go ahead and resubmit it for the second time.” A lot of the times that will take care of the problem. But keep in mind that 90% of bad checks are drawn on accounts that are less than a year old. And a lot of times you can tell because the check will be a temporary check or there will be a numbering indication on the check itself. And you know that you may have a problem and it may be part of the reason for the bounced check.

Also, don’t ask for a post-dated check, it may be defensible under bad check statutes. And in dealing with the bad checks after you call the customer, you may want to check with the bank and verify funds and make sure that if you do resubmit it for the second time it’s going to be good funds this time. And if that doesn’t work, or if you deposit it for the second time and it comes back again, use the letter that is laid out here for you. You’ll see in this letter that it references all the facts: the check number, the amount. You want to put your finance charge in there as well your service fee which is the bank charge that you’re passing through to them. And it makes a good strong demand.

You need these state variables to plug in there before you can send this thing and have it be accurate and correct. The following pages in the workbook, it’s called Summary of State Bad Check Laws, this is by state. All of the days that you need to wait before you can send the letter and that needs to be put in the letter as well as the criminal statutes as they apply because writing a bad check is a criminal matter. And it’s interesting to note that if a customer writes a bad check and they file bankruptcy that is not excusable under the bankruptcy. You can still pursue the amount of that bad check directly from the personal individual even though they’re a corporation filing bankruptcy. It’s a total different statue and it’s a state criminal matter.

The IRS Collection Letter

The next item here: IRS collection letter. On the scale from nice to nuclear, this is nuclear. This is the heavy duty collection letter–the industrial strength collection letter–this is what you want to use just before writing the account off, use an attorney, or go to a collection agency. Basically, your loss becomes your customer’s gain. When you reach the point where you feel a debt is not collectible, with the amount isn’t large enough to warrant further action, you can make one last ditch in-house collection attempt before writing it off or kicking it out to an agency.

You basically inform your customer that you will at your option–which gives you an out if you don’t go through with it–report the discharged debt to the IRS as debt cancellation income. In other words, your firm’s loss becomes your customer’s gain and as such can be reported to the IRS on form 1099 miscellaneous or C as income to the debtor. Note that the debtor must be solvent and there are some particulars with this technique. As a matter as a fact, this technique has been regarded as controversial by those that either didn’t understand the technique or considered it more of an accounting function than a collection function.

Ladies and gentlemen, I want to tell you, in my opinion, there is a huge difference between collections, legal, and accounting. They are three separate specialties. Collections are collections. What happens with this technique once you do your collection process, if it works you get paid, fine, everybody wins, if not, you forward the information to accounting and let them figure out if they’re going to file the 1099c that’s it. That’s a totally different department and it’s not within the realm of collections. Your job is to create a sense of urgency and this letter and this technique is excellent.

It has been approved by a corporate attorney, not to say that you wouldn’t want to have the same thing done on your side. And I’ve also interviewed two IRS field agents to make sure that this technique is both legal and prudent and it’s not going to come back as a violation. And I was told by the IRS field rep that you can use this technique as long as you don’t use the IRS to threaten, intimidate, or induce payment. And none of that is going on here, you just need to be careful because the most effective part of this technique is the followup phone call.

And obviously, you’re setting this whole collection technique up so as to insinuate that they may be audited by the IRS if they don’t fill out the 1099, because if you send that to the blank, obviously it may trigger a red flag. But you just have to be a little bit careful as to how you say that. But what I would suggest is try this technique, have a little fun with it, use it. A lot of my clients and attendees to my seminars try this and I’ve got a strong success rate. People are telling me that they tried this and it worked or it improved their advanced collection percentage recoveries. So give that a try and have some fun with it.

Again, I’ve said this before, collections are all about innovation, creativity. If you look at the second page to the W9, actually the first page of the W9, where it says penalties failure to furnish tax identification number. If you fail to furnish your correct TIN to a requester, which is you sending this collection letter to your customer, you are subject to a penalty of $50 for each failure. And also there’s a $500 penalty if they provide false information. Why not work that into your collection technique when you make the call back after the letter. That’s a very powerful collection technique I hope you try that and even take it to the next level, you may be more successful than I was with it. And I hope that you are.

The Final Demand Letter

The next slide: Collection Agency Demand Letter. Most collection agencies will provide for you for free a collection letter on their letterhead that directs the payment to go straight to you. It mails out, they’ll fax it or mail it to the debtor, typically they’ll mail it. And it’ll direct the money to you. If they don’t pay it says that it’ll go straight into collections. So ask your current agency for this service, it has an attorney letter impact. In my opinion, it’s just as effective as an attorney letter if it’s done properly and they mail it straight to you and if it works it didn’t cost you anything.

Understanding The Value Of Our Collection Letter Process

Making a sale is great, but a sale isn’t a victory until the money is collected. The problem is that accounts receivables are growing faster than sales, and chasing down delinquent debtors is a race against time. The longer an account goes unpaid, the less likely you are to collect payment. Each day that passes is a day closer to it becoming nothing but a direct hit to profit on the bad debt expense line of your balance sheet.

To complete a sale, you need to collect the money. To collect the money, you need a good collections process. These five guides and their respective collection letter samples/templates are designed to help you do that. But no one knows your business the way you do, so it’s up to you to position each letter to represent your business the right way.

Without satisfied customers, there would be no one to purchase your products and services. Keep that in mind when communicating with your customers. However, you need to also keep in mind that a customer is not a customer until the money is in the bank.

No business owner should have to spend that much time getting a customer to pay for a product or service that they provided for that customer. You need to spend less time chasing down delinquent debtors and more time getting paid. When Ben realized this to also be true for himself and his company, he saw no choice but to find a solution.

He was tired of spending so much time making futile attempts at getting what rightfully belonged to him. Ben provides a service and he expects to be paid for that service, as anyone would. Chasing down delinquent debtors was a futile and frustrating task, but he didn’t want to pay a collection agency or attorney to do it for him. He wanted to do it himself. There wasn’t a solution aggressive enough to handle that task, though, so he decided to create one.

That’s when he developed this bulletproof system that has proven to be a complete game-changer in the world of collections. For the first time ever, businesses are receiving payment from their most stubborn debtors, and in half the amount of time, it used to take. They are finally receiving a reward for their effort.

Time is money, and time is your most valuable asset. Why not spend less time on your collections and more time with your family and doing the things you enjoy? Let us help you collect more money at a faster rate and lower cost, without losing valued customers. Start right now by downloading each one of these letter guide tutorials and sample letters today.

“Our company has been using various Stevens & Ricci collection letter templates and we found them to be much more effective than the Transworld Systems pre-paid letters we were using. We actually stopped using the Transworld letters because Stevens & Ricci’s collection letters had better results including more money collected and fewer collection accounts needing to be placed. They’re easy to use.”

– Sandra V. – Salt Lake City, UT

Credit Manager, Transportation Company

“Just wanted to drop you a quick note to let you know how successful your sample IRS collection letter technique has been for me. I have used this technique and have gotten positive responses 4 out of 5 times. I usually send a copy of a W-9 form and highlight the cancellation of debt portion in order to show the account that this is for real. It has been a real gem for me on some of those hard accounts that just refuse to pay, until they think that I am informing the IRS of some unreported income. Thanks again and keep up the good work.”

– James O. – Camden, NJ

Credit Manager, Graphic Arts Supplier

“I mailed 25 debt collection letters based on the IRS Advantage collection program – 15 paid right away without even a follow-up call. These were our most stubborn accounts given one last chance to pay.”

– Angela T. – Brooklyn, NY

Wholesale Fuel Distributor